Today’s cars contain small computers that manage and control almost all parts of the automobile through electronic systems known as ECUs. While features such as driving assist, connectivity, or electrical powertrain become usual, the demands for automotive chips and memory turn exponential. The various categories of memory integrated circuits required in vehicles will also steadily change their capacity within the next decade to meet this demand. The author focuses on the overall trends concerning memory technologies and applications of integrated circuits for automobiles.

DRAM Dominates Today's Automotive Memory Needs

Today’s car manufacturers fit 50- 100 ECUs in their vehicles. They include an Engine control unit, Transmission control unit, Anti-lock Brake System control unit, infotainment control unit, and many others. These ECUs are equipped with different types of integrated circuit memories that store the software code, files of an operating system, and other data such as the buffer data of the sensors or it contains any other temporary data. Out of all the kinds of memory technologies utilized widely in general, DRAM has always been utilized the most in automobiles up until this point.

The DRAM chips use capacitors to store data, but these capacitors must be periodically electrically replenished to keep the stored data intact. This makes DRAM a ‘volatile’ kind of memory technology such that the data it contains is wiped out when the power is switched off except for the situation where the data is transferred to another location. However, the benefit of DRAM includes high memory density, faster access and cycle, and less cost per bit of memory than other types of memory. These traits have transformed DRAM into the preferred memory for the primary memory and buffering systems of automotive ECUs.

Typical ECUs contain between 4-64 megabytes of DRAM. More advanced systems like infotainment modules or advanced driver assistance ECUs can utilize 128 megabytes or greater of DRAM. As automotive electronics' processing power and functionality increase to support new features, so will the memory capacities needed to run them. DRAM continues to be aggressively scaled down in size and powered by lower voltages, allowing increasing amounts to be packed into the limited space inside a vehicle's control units.

Latest Developments in DRAM Memory Standards

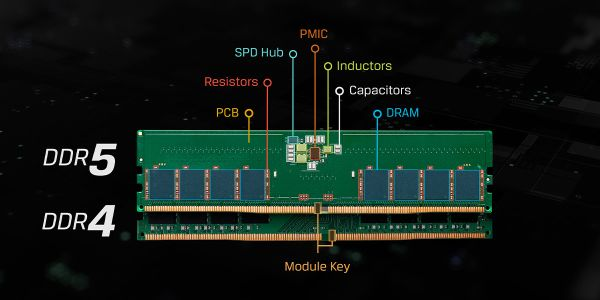

The DRAM market continues to advance key memory interface technologies. DDR5 launched in 2021 and doubles bandwidth over DDR4 to 6.4Gbps while improving power efficiency. DDR5 will be central to high-end computing through the 2020s. GDDR6 entered gaming graphics cards in 2019 with up to 16Gbps data rates and doubles GDDR5 bandwidth. The latest GDDR6X extends this to 21Gbps for next-gen gaming. LPDDR5 targets mobile applications and debuted in 2021 with 6.4Gbps transfers and up to 12GB capacities per chip.

It offers around 2x the bandwidth of LPDDR4. LPDDR5X looks to enhance mobile RAM further and is sampling this year. These newest DRAM standards are enabling powerful new computing experiences through massive increases in memory bandwidth. Automotive and high-speed networking applications also evaluate DDR5 and GDDR6 adoption to support advanced driver-assistance and autonomous vehicle systems with ultra-high speed sensor processing and data streaming requirements.

Flash Memory Gains Traction for Code Storage

While DRAM meets the temporary and buffering memory needs of ECUs quite well, it is ill-suited for long-term data retention when power is removed. That is where flash memory integrated circuits excel. Flash memory-based technology is categorized as “non-volatile” memory storage as erases and writes are permanent even with the power switch off.

There are two main types of flash memory used in automotive applications - NOR and NAND. NOR flash has excellent random read access times making it ideal for code storage. PCM has functional density, writing speed, and non-volatile attributes over NAND and could replace NOR flash in automotive applications, boot-up routines, and over-the-air update functions. NAND flash allows for higher densities at lower costs per bit than NOR but has slower read/write speeds, relegating it primarily to data storage applications.

ECUs requiring robust code and firmware storage increasingly adopt NOR and/or NAND flash technologies. Advanced driver assistance ECUs and infotainment modules may contain 16-64 megabytes of flash memory. The firmware for an engine control module could range from 1-4 megabytes stored in a flash. Automakers also employ larger centralized compute modules utilizing multi-gigabyte flash storage for map databases, music libraries, and software/OS files.

Looking ahead, 3D NAND flash promising up to 256 gigabyte densities is a prime candidate to handle the immense data volumes of in-vehicle infotainment, navigation, and future software updates over cellular modem capabilities. The transition to flash for code and software is increasing the non-volatility and ruggedness of automotive memory systems overall.

Emerging Memory Technologies on the Horizon

While DRAM and flash memory will continue powering most automotive applications today and soon, new memory technologies are on the cusp of being introduced into some vehicle systems starting within the next 5 years:

- 1. MRAM - Magnetic RAM or MRAM utilizes magnetic charges rather than electrical charges to represent data bits. It offers non-volatility, high density, and fast access/write times better than Flash. MRAM is positioned for buffering and small storage needs where high speeds are important.

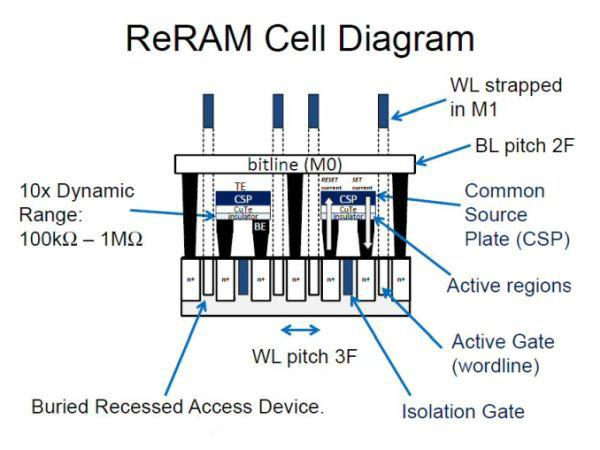

- 2. ReRAM - Resistive RAM or ReRAM uses a metal oxide layer between two electrodes that can be electrically altered to represent ones and zeros. It promises densities on par with DRAM/NAND but with better write endurance than flash and a simpler fabrication process than other emerging memories.

- 3. PCM - Phase-change memory (PCM) encodes bits by altering the amorphous/crystalline phase of an alloy using heat pulses. PCM has density, speed, and non-volatility advantages over NAND and can potentially replace NOR flash in some automotive applications.

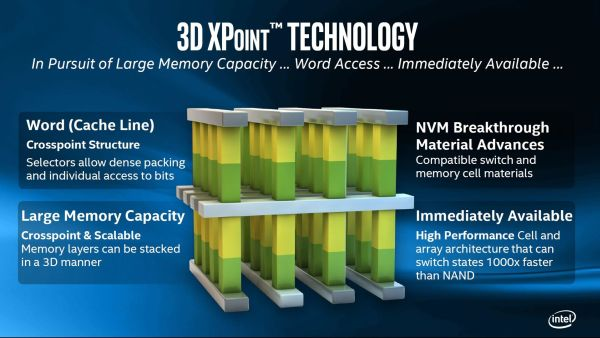

- 4. 3D XPoint- Intel and Micron’s 3D XPoint is a phase-change-based NVMe that is as fast as NAND, and 10 times denser than DRAM. It can replace DRAM, flash, and HDDs in some systems that require high speed, large capacity, and low power.

The first wide adoption of these new memory technologies will likely be for non-critical ECU applications demanding faster access to buffers and larger storage capacities such as advanced infotainment and driver assistance. Over time, they could permeate into safety-critical systems as well. Whether it emerges in 5 years or later, 3D XPoint seems poised to potentially upset multiple memory market segments, including several automotive domains.

Emerging Memory Technologies Poised for Automotive Adoption

Though DRAM and NAND flash are likely to remain in the automotive sector for at least the next five to ten years, the novel generations of memory boast specific perks that would bring them into automobile production in the upcoming 5-10 years. This section examines the current state and potential automotive roles of three leading contenders: Magnetoresistive RAM, which is classified as a spin-torque transfer RAM or spin-orbit torque RAM, Resistive RAM, and the emerging 3D XPoint.

Magnetoresistive RAM (MRAM)

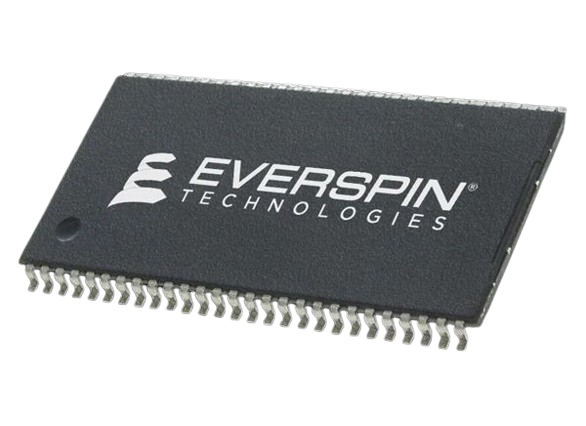

MRAM is a non-volatile memory that works by altering the magnetic properties of thin films rather than electrical charges. It exhibits read/write speeds rivaling DRAM but with the data persistence of flash memory. MRAM is also exceptionally durable, with virtually unlimited read/write endurance compared to other technologies.

A key attribute is its compatibility with conventional CMOS semiconductor manufacturing processes. Numerous companies have brought MRAM to market at moderate densities targeting enterprise storage and mobile applications. Scaling MRAM to automotive qualifications and densities needed is the remaining challenge.

Several factors position MRAM well for future automotive roles:

1. Rugged design ideal for harsh under-hood environments prone to temperature fluctuations

2. Fast access suits buffer/cache applications like sensor data aggregation

3. Non-volatility ensures robust operation during frequent engine starts/shutdowns

4. Low power aids incorporation into battery-constrained driver assistance systems

5. Lifetime reliability exceeds conventional memory lifespans in vehicles

Major efforts are underway to shrink MRAM components and raise capacities. Once 64Mb and beyond densities are achieved with suitable quality and volume production, MRAM could find initial niches as robust buffer memory closely coupled with microcontrollers. In the long term, it may assume broader automotive applications reliant on long durable data storage.

Latest Developments in MRAM Technology

More recently, two novel variants of MRAM have emerged that could drive further improvements and scale down the technology for even wider applications. Spin-transfer torque MRAM (STT-MRAM) utilizes electric currents to directly alter the magnetic polarization of a ferromagnetic layer, allowing for faster writes and lower power consumption compared to the field-induced switching mechanism of traditional MRAM. One drawback is that STT-MRAM still requires multiple transistors per bit limiting density scaling. However, spin-orbit torque MRAM (SOT-MRAM) addresses this issue through an innovative "spin-hall effect" write mechanism utilizing heavy metals like tantalum that enables achieving the performance and energy efficiency gains of STT-MRAM but with a simple cross-point cell architecture similar to ReRAM. STT-MRAM and SOT-MRAM are now actively developed by companies like Everspin, Avalanche, and Crocus Nanotech. Suppose challenges around cell endurance and manufacturing yields can be overcome. In that case, these new MRAM variants show strong potential to outperformDRAM, flash, and ReRAM in various applications such as automotive where ruggedness, speed, and low power are priorities.

Resistive RAM (ReRAM)

ReRAM leverages a simple metal-oxide-metal 'memristor' structure to represent binary data. The resistance level of the metal oxide defines stored values. ReRAM offers promising characteristics for memory scaling and high-density applications.

Prototype ReRAM arrays have surpassed DRAM densities at lower power and faster speeds than NAND flash. ReRAM components to date exhibit favorable traits that could make it an automotive memory contender:

- 1. Simple fabrication is highly manufacturable at small scales

- 2. Low power consumption complements the needs of energy-sensitive automotive hardware

- 3. Fast read/write times enhance computational throughput

- 4. Multilevel cell architecture enables high densities

Although ReRAM has yet to achieve mass production at automotive qualifications, its progress is noteworthy. Fujitsu brought 64Mb ReRAM DDR3 modules to market in 2020. Meanwhile, Micron and Intel have demonstrated 128Gb ReRAM chips positioning this contender at threshold densities.

ReRAM shows potential for a range of automotive applications:

- 1. Integrated storage within microcontrollers and SoCs

- 2. Embedded database indexing owing to multidimensional cell architecture

- 3. Shared storage mediums for IVI systems requiring compact high-density memory

- 4. Future in-vehicle storage area network memory pools

Once 512Mb densities with suitable endurance are realized, ReRAM's high degree of integration and low power could make it an appealing automotive memory candidate, particularly for safety-critical compute modules where memory and processing are tightly coupled.

Modern Developments in Resistive RAM (ReRAM) Technology

TSMC Develops 22ULL eRRAM for Embedded Applications

One of the latest advances in Resistive RAM technology comes from foundry giant TSMC, which has developed a 22nm ultra-low-leakage embedded ReRAM (eRRAM) process called 22ULL. This novel eRRAM incorporates ReRAM memory cells directly into the backend of logic circuits fabricated on their 22ULL process. At a storage density of 4Mb per square millimeter, the 22ULL eRRAM achieves 100 times the density of traditional embedded flash without requiring the large die sizes of standalone ReRAM chips. Even more compelling is that the process offers 60x lower static power consumption than 28nm flash and supports up to 1 million high-speed read/write cycles. TSMC’s eRRAM also exhibits fast 10ns read/write times and multi-bit storage abilities. These advantages make 22ULL ReRAM an optimal embedded non-volatile solution for IoT devices, wearables, and even automotive applications where integrated storage is needed. TSMC’s early customers including Qualcomm and MediaTek have already adopted 22ULL eRRAM into their latest system-on-chips. If production yields and endurance can be further improved, eRRAM has strong potential to displace flash in many integrated circuits requiring on-die non-volatile memory storage.

3D XPoint (Cross-Point) Memory

Developed through a joint Intel-Micron venture, 3D XPoint distinguishes itself as a non-volatile memory technology positioned between DRAM/flash and hard disk drives in access speed, capacity, and manufacturing cost.

Its novel cross-point architecture leverages the resistance-changing properties of chalcogenide glasses to enable fast multibit storage within a small cell. This enables 3D XPoint's touted combination of DRAM-like throughput with far denser capacities than NAND flash.

Significant challenges remain in scaling 3D XPoint arrays, yet prototypes have achieved 128Gb densities with nanosecond access latencies. If scaling targets are met, 3D XPoint portends storage capacities on par with today's largest SSDs but with faster access enabling new applications.

3D XPoint's traits align well with automotive storage needs:

- 1. Rugged non-volatile memory retains data without power

- 2. Fast access complements real-time processing/analytics demands

- 3. Potential SSD-comparable capacities enable centralized automotive data stores

- 4. Low power dissipation meets the requirements of under-hood and battery-fed devices

Current 3D XPoint SSDs target enterprise servers and data centers. As the technology matures to 512Gb or 1Tb densities with stringent automotive qualifications, it could serve as ideal shared storage in centralized SAN pools interconnecting ECUs at multigigabit speeds.

Its disruptive bandwidth-capacity blend could even challenge traditional NAND flash roles like zone controller firmware storage. Overall, 3D XPoint represents a leading candidate to reshape automotive memory architecture by enabling terabyte-scale consolidated pools delivering data at memory-like speeds throughout the vehicle.

Outlook

These early-stage memory technologies illustrate the opportunities emerging that could fundamentally alter automotive electronics in the years ahead. As is evident, each exhibits traits mapping well to evolving requirements around non-volatility, density scaling, bandwidth, low power, and integration density that vehicles demand.

Given automotive development cycles, these memories may first materialize within less critical automotive subsystems by the mid-2020s. But over the long run, their advantages could see broad assimilation into core vehicle control systems reliant on robust memory services. Overall, the automotive industry stands on the cusp of a memory revolution enabled by technologies like MRAM, ReRAM, and 3D XPoint carrying vehicle capabilities far beyond what current DRAM/flash memory enables.

In-Vehicle Storage Area Network on the Horizon

Another outgrowth of rising memory capacities is the emergence of in-vehicle storage area networks or SANs. Currently, most ECUs utilize local memory storage in an isolated fashion. But as capacities scale upwards and data volumes soar with features like map databases and software/firmware updates, centralized memory pools will become necessary.

A SAN connects multiple ECUs and other computing devices within the vehicle to pools of high-capacity shared memory resources using a high-speed network. This allows individual ECUs to leverage far more memory than their local capacities could provide alone. The auto industry is starting to support networking standards like AUTOSAR and CAN-FD to facilitate in-vehicle SAN topologies.

Initially entry-level SANs may involve multi-gigabyte centralized pools of flash memory accessible over 100Mbps CAN-FD buses. Later systems featuring 24-100Gbps Ethernet could link terabytes of memory dispersed in strategic locations throughout the vehicle. Technologies like 3D NAND, 3D XPoint, and even ReRAM will be necessary to physically construct such highly scalable shared memory subsystems cost-effectively.

SANs can reduce overall automotive memory costs through economies of scale. They enhance functionality by allowing any ECU access to a much larger unified data store. SAN memory configurations can be seamlessly updated over the air throughout the life of a vehicle. The storage area network concept is a logical progression that will redefine how automotive electronics utilize integrated circuit memory resources in the future.

Memory Applications Evolving with New Automotive Technology

The evolution of memory technologies like 3D XPoint, ReRAM, PCM, and larger capacity flash plus deployment of SAN architectures will enable groundbreaking new capabilities for automotive electronics and transportation technologies emerging over the next decade:

- 1. Autonomous and Semi-Autonomous Vehicles - Advanced driver assistance systems relying on AI, deep learning, and high-definition sensor fusion require massive data processing power and storage capacities far exceeding today's vehicles. Petabyte-scale storage pools will leverage the density, speed, and network connectivity of future memory technologies.

- 2. Vehicle-to-Vehicle and V2X Communications-Inter-vehicle and vehicle-to-infrastructure data exchanges involve streaming high bandwidth sensor and telemetry data between many vehicles simultaneously. Future memory could facilitate real-time analysis and distribution of petabytes of crowd-sourced road data.

- 3. Electric and Hybrid Powertrains - Memory-intensive battery management systems precisely controlling hundreds of high-voltage battery cells will leverage emerging non-volatile memory's low-power attributes and fast access essential for safety-critical functions.

- 4. Advanced Infotainment - Future vehicles are destined to become personalized mobile devices and digital platforms on wheels. Entertainment experiences will seamlessly integrate interactive 3D mapping, augmented reality overlays, and software delivered over the air which requires massive storage pools memory technologies like 3D XPoint enable.

- 5. Predictive Maintenance Telematics - As automakers collect diagnostic and usage metrics from millions of worldwide vehicles, predictive analytics algorithms can remotely flag potential issues before failures occur - provided future high-capacity shared memory complements vehicles' long-term cellular connectivity capabilities.

Memory - the Foundation of Future Mobility

As transportation increasingly assimilates mass data collection, processing, and communications, integrated circuit memory will become a foundational technology shaping the capabilities and user experiences of future mobility solutions. Already we are seeing nascent uses of DRAM and flash alongside emerging memory forms enabling new semi-autonomous driving modes and digital content delivery. But that is only the beginning.

Over the next decade, memory scaling and novel non-volatile technologies will revolutionize automotive data storage, enabling vehicles to become rolling supercomputers. Shared memory subsystems and vast in-vehicle data pools will allow intelligent transportation solutions of the coming era to perform feats of sensing, computation, and network coordination that remain unfathomable today. The future of mobility is being written in zeros and ones - and the circuits that capture them will determine just how smart, connected, and autonomous our transportation becomes.

Conclusion

In summary, automotive integrated circuit memory plays a vital supporting role that will become increasingly critical as advanced electronics drive innovation across the transportation industry. DRAM and flash memory will continue fulfilling the lion's share of current automotive memory needs, aided by aggressive scaling, but nascent technologies have the potential for disruption. Storage area networks presage wholly new memory architecture paradigms for vehicles. Overall, integrated circuits and the memory media within them form the substrate upon which intelligent mobility solutions of the future will materialize. The continued evolution of memory technologies will power automotive capabilities scarcely imaginable today toward creating a brilliant, connected, and autonomous transportation landscape ahead.

Comment